jersey cash 5 payouts after taxes

Although the initial rate is 24 you need to report your income. It is important to note that prizes in excess of 5000 will be charged withholding tax at the federal level.

Lottogo Winners Stories Learn About Our Winners Here

Yes you heard it right.

. The Powerball annuity jackpot is awarded according to an annually-increasing rate schedule which. Arizona Taxes Paid 5 30500. 6 New York state tax on lottery winnings in USA.

Yokastoa Boyer from Clifton New Jersey was cleaning her room and organizing some documents for the coming tax season when she found a Jersey Cash 5 XTRA lottery ticket for the April 14 2015 draw. All prizes are pari-mutuel so the amount can vary. 882 North Carilona state tax on lottery winnings in USA.

New Jersey Cash 5 prizes in excess of 5000 will be subject to federal withholding tax while prizes in excess of 10000 will also be subject to gross income tax both at. New Jersey NJ Lottery Jersey Cash 5 prizes and odds by Lottery Post Lottery Post is proud to bring you winning ticket jackpot prize payout amounts and game odds for New Jersey NJ Jersey Cash 5. Ensure you claim your Jersey Cash 5 prize within 1 year from the drawing date.

1 Each Jersey Cash 5 play costs 1. The best after-tax and payout calculator is available at USA Megas jackpot analysis page. New Jersey Cash 5 State Lottery offers unbelievable lifetime cash prizes.

New Jersey NJ Jersey Cash 5 latest winning numbers plus current jackpot prize amounts drawing schedule and past lottery results. 25 State Tax. She claimed the ticket right on time too.

A federal tax of 24 percent will be taken from all prizes above 5000 including the jackpot before you receive your prize money. Lump SumCash Option Calculator. Mark the circle to add XTRA for an additional 1 per play per draw to increase non-jackpot Jersey Cash 5 prizes.

And you must report the entire amount you receive each year on your tax return. The rate for non-residents is higher and set to 30. After checking the numbers Boyer was shockedshe had just won 472271.

That means your winnings are taxed the same as your wages or salary. The higher State withholding rate of 8 percent also applies to any prize in excess of 10000 paid to a winner who does not furnish a taxpayer identification social security number. State law requires the New Jersey Lottery to withhold State tax at the rate of 5 percent from any prize in excess of 10000 and up to 500000 or 8 percent from any prize in excess of 500000.

Overall odds of winning a prize in Jersey Cash 5 are 1 in 153. 2 Pick five5 numbers between 1-45. If you match 2 3 or 4 numbers you will always win the full amount.

25 State Tax. Jersey Cash 5 XTRA is known to offer a jackpot that starts rolling at 100000 and keeps rolling until theres a winner. For those prizes in excess of 10000 a New Jersey gross income tax withholding will be charged.

Know more about the statistics past data rules FAQs and upcoming Jackpots at The Lottery Lab for your assistance to win. 8 New Maxico state tax on lottery winnings in USA. To make your game more exciting the New Jersey Lottery lets you have XTRA to multiply your non-jackpot winnings or.

25 State Tax. Winners win the full prize amount for the prize level won less taxes if applicable with one exception. 1 in 1221759.

12 20 21 22 33 2. Federal Taxes Paid 24 146400. New Jersey state tax on lottery winnings in USA.

Net Payout after taxes 433100. Gross Payout 61 of the jackpot 610000. 3 If youd rather have the Lottery computer randomly select your numbers for you ask your Retailer for a Quick Pick Or if youre using a play slip mark the Quick Pick QP circle.

The game draws daily with an option of Multi-Draws which actually works in increasing your chances to crack super easy odds of 1 in 1221759. 25 State Tax. If there are more than 10 tickets that match all five numbers in a single drawing 5 of 5 those winners will receive an equal share of the 200000 prize liability limit.

If you end up in the top bracket and that is often the case when jackpots are. However here is another perk for the residents. View the Jersey Cash 5 Payouts and prize table for the latest draw below held on Friday March 18th 2022.

Along with a play in the simulation. The calculations are based on a 1 billion annuity or. You may then be eligible for a refund or have to pay more tax when you file your returns depending on your total income.

For example lets say you elected to receive your lottery winnings in the form of annuity payments and received 50000 in 2019. You must report that money as income on your 2019 tax return. If you win the jackpot you will be subject to the top federal tax rate of 37 percent.

Find out if youve won the jackpot or if its rolled over to the next draw.

Iv Income And Wealth Taxes In Tax Policy Handbook

Countries Requiring Covid Test For Travelling Covid Smart

How To Assess Fiscal Risks From State Owned Enterprises Benchmarking And Stress Testing In Imf How To Notes Volume 2021 Issue 009 2021

Jersey Cash 5 New Jersey Nj Lottery Results Game Details

Def 14a 1 Nc10016216x1 Def14a Htm Def 14a Table

Money And Collateral In Imf Working Papers Volume 2012 Issue 095 2012

Def 14a 1 Nc10016216x1 Def14a Htm Def 14a Table

Is Life Insurance Taxable Forbes Advisor

S 1 A 1 Bivi 20200714 S1a10 Htm S 1 A As

S 1 A 1 Tm2018577 4 S1a Htm S 1 A As

Lottogo Winners Stories Learn About Our Winners Here

How To Claim A Hurricane Loss On Your Tax Return Forbes Advisor

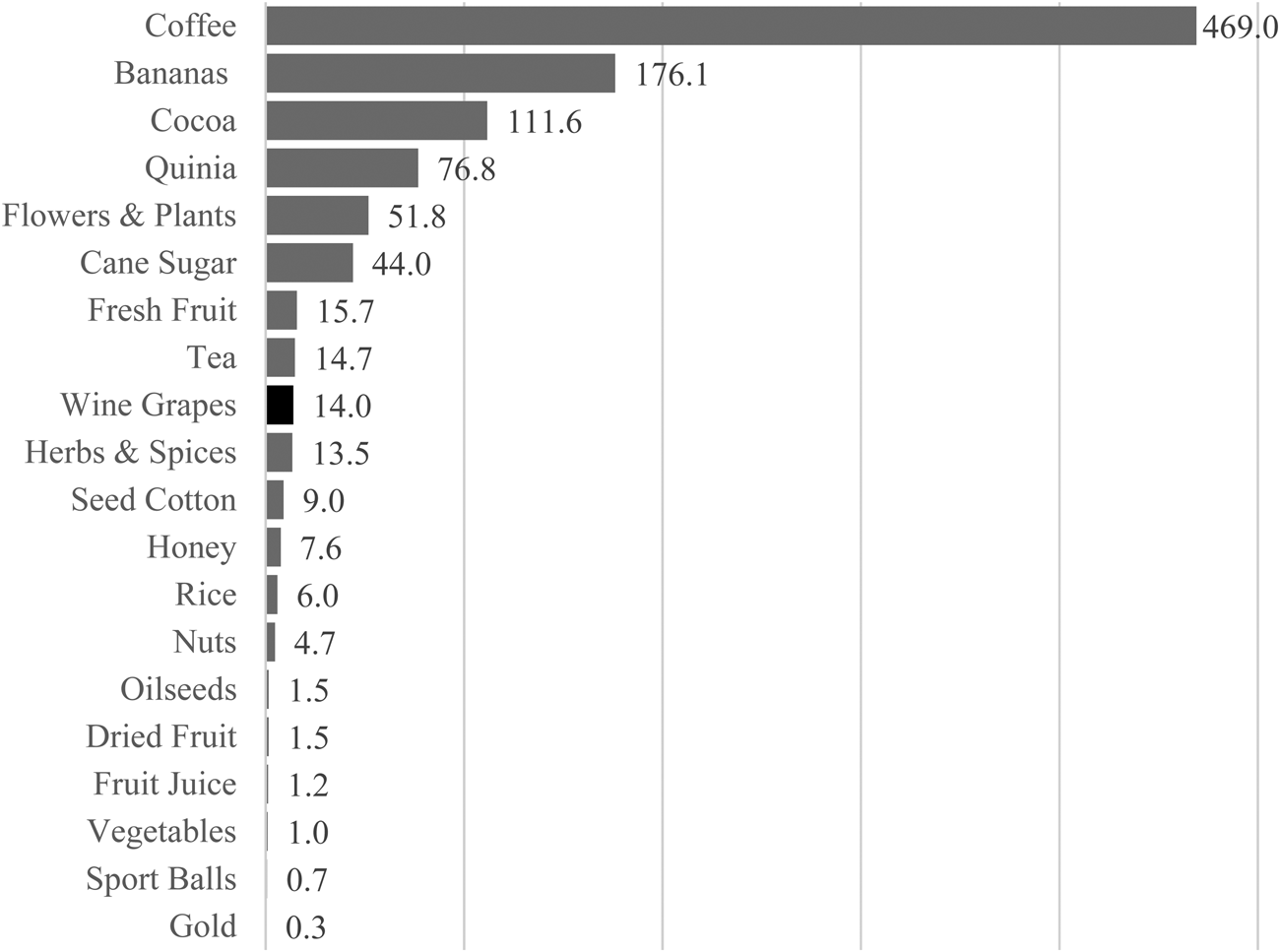

Margins Of Fair Trade Wine Along The Supply Chain Evidence From South African Wine In The U S Market Journal Of Wine Economics Cambridge Core